Visualizing Efficiency: A Business Process Diagram of the 3-Way Matching Workflow

Ensuring financial accuracy and preventing errors in payments is critical. One of the most reliable methods companies use for this purpose is the 3-way matching process. This process helps verify that every purchase made by an organization aligns with the purchase order, the goods received, and the supplier’s invoice. To make this complex process easy to understand and manage, businesses often turn to a business process diagram — a visual map that shows how data and approvals flow from one step to another.

By visualizing the 3-way matching workflow, companies can quickly identify bottlenecks, improve internal controls, and ensure that payments are made only when everything checks out. This article explains how a business process diagram simplifies the 3-way matching workflow, its components, and why visualization drives greater efficiency and accuracy.

Understanding the 3-Way Matching Workflow

The 3-way matching process is a key part of accounts payable management. It ensures that before an invoice is paid, three essential documents are verified and matched:

Purchase Order (PO): Confirms that goods or services were ordered.

Goods Receipt Note (GRN): Confirms that the items were actually received.

Supplier Invoice: Confirms the price and quantity billed.

When all three documents match, the system approves the payment automatically. If there’s a mismatch—such as a difference in price, quantity, or delivery date—the process halts, and the issue is flagged for review.

In traditional setups, this process often involves manual cross-checking of records, leading to errors and delays. But with workflow automation tools like Cflow, the entire matching process can be automated, ensuring faster, error-free approvals and complete audit trails.

Why Visualization Matters in Workflow Management

A business process diagram acts as a blueprint for understanding complex workflows. Instead of reading through lengthy SOPs or policy documents, teams can see every step clearly — who is responsible, what inputs are needed, and how tasks flow between departments.

When applied to 3-way matching, visualization brings several benefits:

Transparency: Every stakeholder can see where a transaction currently stands.

Error Detection: Mismatches or data inconsistencies are spotted early.

Process Standardization: The same approval logic applies to all vendors and purchases.

Audit Readiness: Every decision point and approval is recorded visually.

By converting the 3-way matching workflow into a process diagram, finance and procurement teams gain a clear, end-to-end view of how invoices move from creation to payment.

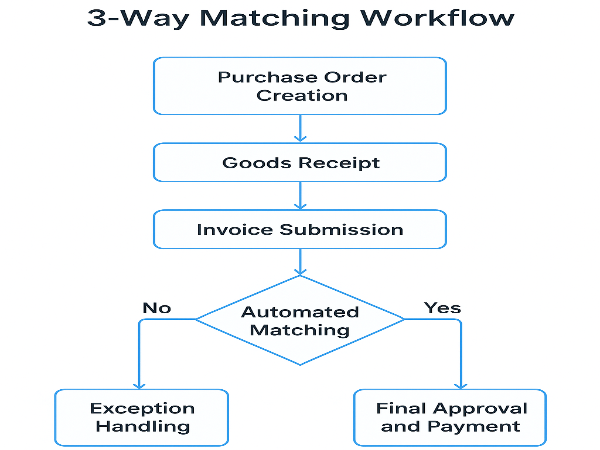

Key Stages in a 3-Way Matching Process Diagram

A well-designed process diagram for 3-way matching typically includes the following stages:

Purchase Order Creation: The process begins when a department requests goods or services. Once the PO is approved, it’s sent to the vendor.

Goods Receipt: When the vendor delivers the goods, the warehouse or receiving team verifies the shipment and logs a Goods Receipt Note.

Invoice Submission: The supplier submits the invoice to the accounts payable team, referencing the PO number.

Automated Matching: The system compares the PO, GRN, and Invoice data. If all three match, the invoice moves to the payment approval stage automatically.

Exception Handling: If discrepancies arise, the process routes the task to the responsible department (procurement, finance, or receiving) for correction or clarification.

Final Approval and Payment: Once all issues are resolved, the payment is released to the vendor, and the transaction is recorded for audit purposes.

Visualizing these stages in a business process diagram helps ensure that no step is skipped and that all data flows in a structured, traceable manner.

Automation and Efficiency with Workflow Tools

Modern no-code workflow automation platforms like Cflow make it easy to design and automate a 3-way matching workflow without writing a single line of code. Using intuitive drag-and-drop tools, finance teams can build a visual flow of approvals, rules, and conditions.

Automation provides:

Speed: Approvals happen instantly once matching is confirmed.

Accuracy: Human error is minimized through data validation.

Scalability: The same workflow can handle thousands of transactions across multiple departments or regions.

Compliance: Built-in checks ensure all transactions follow internal policies and audit requirements.

The visual approach ensures that teams don’t just automate blindly — they understand the logic, flow, and decision points behind every step.

Real-World Benefits of Visualizing the Workflow

By adopting a business process diagram for the 3-way matching workflow, organizations can expect:

Reduced Processing Time: Automated routing eliminates manual follow-ups.

Lower Costs: Errors and duplicate payments are prevented before they occur.

Improved Vendor Relationships: Faster payments lead to better trust and collaboration.

Enhanced Reporting: Managers get a real-time snapshot of pending approvals or mismatched invoices.

In large enterprises, visualization also helps with onboarding new employees faster — they can easily grasp how finance processes work by viewing the diagram instead of reading long policy documents.

Conclusion

Visualizing the 3-way matching process through a business process diagram is more than a design exercise — it’s a step toward smarter, more transparent financial management. When teams can see how every approval, match, and verification fits together, they gain better control over operations and reduce the risk of costly errors.

As organizations continue to embrace automation, platforms like Cflow empower finance and procurement teams to create, visualize, and optimize these workflows effortlessly. The result? Faster approvals, cleaner audits, and stronger financial governance — all driven by the power of visualization and automation.