Smart Payments Start Here: eWallet App Development Services

Introduction: The Evolution of Smart Payments

In the digital era, convenience and speed have become the foundation of financial transactions. Gone are the days when people relied solely on cash or cards. The new generation of payments is smart, secure, and seamless — all thanks to eWallet app development services.

From small startups to large enterprises, everyone is adopting digital wallets to empower customers with quick, contactless, and transparent payment options. According to Statista, over 5 billion people are expected to use mobile wallets by 2026, making it one of the fastest-growing sectors in fintech.

So, what makes eWallets the future of payments? Let’s explore how businesses can leverage this technology to redefine their customer experience.

What Are eWallet App Development Services?

An eWallet app (or mobile wallet) is a digital platform that allows users to store money, transfer funds, pay bills, and make online purchases without needing physical cash or cards.

eWallet app development services involve creating custom mobile applications that simplify financial transactions while ensuring strong data security and compliance.

Types of eWallets

| Type | Description | Example |

| Open Wallets | Allow users to perform transactions across multiple merchants and withdraw money to bank accounts. | PayPal, Google Pay |

| Closed Wallets | Issued by specific companies for use only within their ecosystem. | Amazon Pay |

| Semi-Closed Wallets | Work with selected partner merchants for limited transactions. | Paytm, PhonePe |

Each type serves a different business need — from retail transactions to peer-to-peer payments — making eWallets a powerful financial innovation.

Key Benefits of Using eWallets for Businesses and Users

Both businesses and consumers gain significant advantages from adopting eWallet technology.

For Businesses:

- Faster Payments: Instantly receive funds without delays caused by bank processes.

- Enhanced Customer Loyalty: Integrated rewards and cashback programs drive repeat usage.

- Reduced Operational Costs: Automation eliminates the need for manual transaction management.

- Global Reach: Businesses can accept payments from customers across borders.

For Users:

- Convenience: Access all financial tools in one app.

- Security: Encrypted transactions protect sensitive data.

- Speed: Instant payments with minimal steps.

- Rewards & Offers: Many wallets offer personalized discounts and cashback deals.

| Benefit | Businesses | Users |

| Speed | Instant fund transfer | Quick checkout |

| Cost Efficiency | Low transaction fees | No hidden charges |

| Engagement | Rewards & loyalty points | Personalized offers |

| Security | Fraud prevention tools | Data encryption |

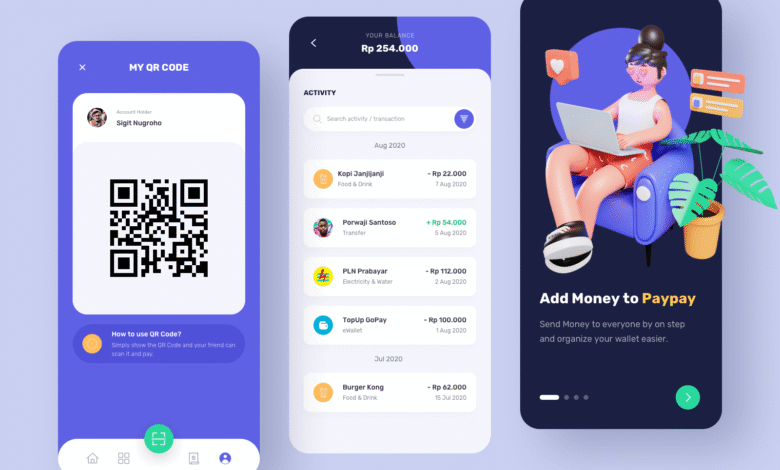

Core Features of a Smart eWallet App

A smart eWallet app should be built with a combination of essential and advanced features to ensure functionality, security, and engagement.

Essential Features

- User Registration & KYC Verification – Simplifies onboarding and maintains compliance.

- Balance Management – Allows users to check available funds easily.

- Money Transfers & Payments – Enables peer-to-peer and merchant payments in real time.

- Transaction History – Offers transparency with detailed transaction records.

- Push Notifications – Keeps users informed of transactions, offers, and alerts.

Advanced Features

- Biometric Authentication – Adds fingerprint or facial recognition security.

- QR Code Payments – Enables quick payments by scanning codes at merchant points.

- AI-Powered Recommendations – Personalizes offers and spending insights.

- Crypto Integration – Allows payments using cryptocurrencies like Bitcoin or Ethereum.

- Bill Reminders & Auto-Pay – Simplifies monthly payments automatically.

| Feature Type | Example | Benefit |

| Basic | Wallet balance, transactions | Usability |

| Security | Biometric, OTP | Data protection |

| AI Features | Spending insights | Personalization |

| Utility | QR payments, auto-bills | Convenience |

Technology Stack for eWallet App Development

Behind every successful eWallet app lies a robust technology stack that ensures speed, reliability, and security.

Frontend Technologies

- React Native / Flutter: For smooth cross-platform app development.

- Swift / Kotlin: For native iOS and Android development.

Backend Technologies

- Node.js / Python / Java: Build powerful, scalable backend systems.

- MongoDB / PostgreSQL: For fast, secure data management.

Key Integrations

- Payment Gateways: Stripe, PayPal, or Razorpay.

- Cloud Platforms: AWS, Google Cloud, or Azure for hosting.

- Security Tools: SSL encryption, tokenization, and firewalls.

| Layer | Technologies | Purpose |

| Frontend | Flutter, React Native | User interface |

| Backend | Node.js, Python | App logic |

| Database | MongoDB, MySQL | Data storage |

| Cloud | AWS, Azure | Hosting |

| Security | SSL, OAuth | Protection |

A well-chosen tech stack ensures that your app runs efficiently, scales easily, and remains secure against threats.

Security Framework in eWallet App Development

Security is the heart of any financial application. Since eWallets handle sensitive data like card numbers and banking details, maintaining top-tier protection is essential.

Key Security Features

- Data Encryption: Protects user information during transfer.

- Tokenization: Replaces sensitive data with secure tokens.

- Two-Factor Authentication (2FA): Adds an extra layer of verification.

- Real-Time Fraud Detection: AI algorithms monitor unusual activity.

- Compliance Standards: Must follow PCI DSS, GDPR, and AML/KYC guidelines.

Tip: Always include continuous monitoring and regular audits to ensure your app remains secure and compliant.

| Security Method | Description | Benefit |

| Encryption | Converts data into unreadable format | Prevents leaks |

| Tokenization | Replaces card info with tokens | Enhances safety |

| 2FA | Dual verification step | Stops unauthorized access |

| AI Monitoring | Detects suspicious activity | Prevents fraud |

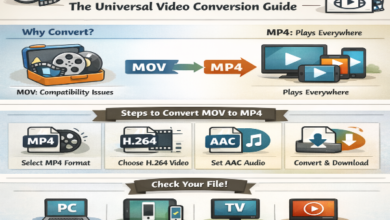

Step-by-Step Process of Developing a Smart eWallet App

Developing a successful eWallet app involves several strategic stages. Each step contributes to creating a product that’s functional, user-friendly, and compliant.

Market Research & Planning

- Analyze competitors and identify your unique value proposition.

- Define target users, core features, and monetization models.

UI/UX Design

- Create interactive wireframes and prototypes.

- Focus on clean, intuitive layouts for better usability.

Development

- Backend team sets up databases, APIs, and server logic.

- Frontend developers bring design to life with smooth performance.

Testing & QA

- Conduct performance, functionality, and security tests.

- Fix bugs and optimize speed before deployment.

Deployment

- Launch your app on Play Store and App Store.

- Monitor performance metrics after going live.

Maintenance & Updates

- Regularly update features and patch security issues.

| Phase | Key Activity | Outcome |

| Research | Market study | Clear roadmap |

| Design | Prototypes | User-friendly interface |

| Development | Backend + Frontend | Working app |

| Testing | QA & security checks | Bug-free version |

| Launch | App store release | Live product |

Cost and Time Estimates for eWallet App Development

The cost of developing an eWallet app depends on various factors, including complexity, region, and features.

Major Cost Factors

- App complexity and design quality

- Number of integrated APIs

- Choice of technology stack

- Developer location and expertise

Average Cost Breakdown

| Type of App | Estimated Cost | Development Time |

| Basic eWallet App | $25,000 – $40,000 | 2–3 months |

| Mid-Level App | $50,000 – $80,000 | 3–5 months |

| Advanced/Enterprise App | $100,000+ | 6–9 months |

Note: Outsourcing development to trusted partners in regions like Eastern Europe or South Asia can significantly reduce costs while maintaining quality.

Choosing the Right Development Partner

Selecting a professional eWallet app development company is crucial for ensuring long-term success.

What to Look For

- Experience in FinTech Projects – Choose teams that understand regulatory and technical complexities.

- Strong Portfolio – Review past projects for quality assurance.

- Data Security Expertise – Ensure the company follows encryption and compliance standards.

- Transparent Pricing – Avoid agencies that hide costs or charge for every minor update.

- Post-Launch Support – Continuous maintenance ensures smooth operation after release.

| Criteria | Why It Matters |

| FinTech Experience | Reduces compliance risks |

| Security Knowledge | Protects sensitive data |

| Transparent Pricing | Builds trust |

| Support | Ensures app stability |

A good development partner doesn’t just code your app — they collaborate strategically to help your business scale securely.

Conclusion: The Future of Smart Payments and Digital Wallets

As technology advances, eWallets will continue to lead the evolution of digital payments. With the rise of AI, blockchain, and contactless technology, the potential for innovation in this space is endless.

For businesses, offering a digital wallet isn’t just a convenience — it’s a strategic advantage. It builds trust, enhances engagement, and positions your brand at the forefront of the digital economy.

By investing in smart eWallet app development services, you’re not only empowering your customers but also preparing your business for a future where cashless, seamless, and secure payments are the norm.

Smart payments don’t just start here — they redefine how the world transacts.