Keeping Farm Businesses Strong During Family Changes

Family farms across the UK operate at the intersection of work, property, and family life. When relationships change, the impact reaches far beyond the household. Land, machinery, livestock, housing, and income often sit within the same structure. Separation can place pressure on every part of the business if decisions are delayed or roles become unclear.

Farms rarely function as simple commercial entities. Many support several generations and provide income for extended family members. When a marriage or partnership ends, uncertainty around ownership, control, and daily operations can threaten long-term stability. Early structure matters. Clear decisions protect both the people involved and the business itself.

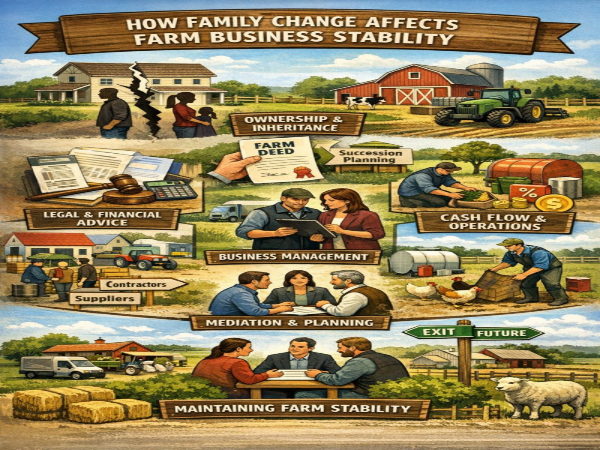

How Family Change Affects Farm Business Stability

Farm businesses face risks that differ from other family-owned enterprises. Assets are rarely cleanly divided. Land may be inherited, homes may sit on business property, and income often depends on seasonal cycles rather than fixed salaries. Separation can interrupt decision-making at critical moments.

Without agreed arrangements, shared accounts may stall payments to suppliers or staff. Orders for feed, fuel, or equipment can be delayed. Daily operations suffer while personal disputes remain unresolved. Employees notice instability quickly, and concern can spread across the wider rural network.

Farm disruption does not stay contained. Local contractors, merchants, and service providers feel the effects when purchasing patterns change. Protecting farm business resilience helps safeguard both the farm and the surrounding community.

Operational Structures That Reduce Risk During Family Change

Farm businesses often look for ways to reduce exposure when personal relationships affect operations. Separating ownership, management, and daily decision-making can limit disruption during periods of change. In some cases, community farm ownership models provide a structure that protects long-term operations while allowing families to resolve personal matters without placing the business at risk.

Legal Structures That Protect Agricultural Assets

Agricultural businesses operate under legal frameworks that require specialist understanding. Tenancy agreements, succession rights, and inheritance history all shape how courts view asset division. These factors often outweigh simple ownership records.

Working with leading family lawyers in Leeds who understand agricultural structures helps families protect viable farm operations during separation. Courts assess whether a business must continue to function to support future income and succession. Legal advice that reflects this reality supports more balanced outcomes.

Many farms rely on informal partnership arrangements. When agreements remain unwritten, courts must determine whether assets belong to the relationship or the wider family business. This distinction influences land ownership, future succession, and operational control. Clear legal positioning reduces the risk of outcomes that undermine the farm’s future.

Maintaining Business Continuity During Separation

Continuity depends on preparation. Families benefit from gathering clear records early. These include inheritance documents, pre-marital ownership evidence, business accounts, and contribution histories. Accurate records support fair valuation and reduce dispute length.

Separating business and personal finances stabilises operations. Dedicated business accounts help ensure wages, supplier payments, and essential costs continue without interruption. Financial clarity protects the farm during periods of legal uncertainty.

Temporary management arrangements also play a role. Interim agreements define responsibility for livestock, cropping decisions, staffing, and purchasing authority. These agreements maintain order while long-term decisions are finalised.

Cash flow protection becomes critical during separation. Farms operate on narrow margins tied to seasons rather than months. Automated payments for essential expenses reduce the risk of disruption caused by delayed decisions or restricted access to accounts.

Separating Personal Conflict From Farm Operations

Clear communication boundaries protect the business. Business-only channels reduce emotional spillover into operational decisions, reinforcing communication boundaries at work that keep discussions focused on farm needs.

Regular meetings with defined agendas help maintain momentum. These meetings should address production, staffing, and logistics only. Personal issues require separate discussion or legal representation.

Neutral third parties can support communication when tensions rise. Accountants, agricultural advisors, or trusted professionals can help guide discussions around operational priorities. Their presence keeps decisions grounded in business reality.

Planning Ahead to Protect the Farm’s Future

Preventive planning reduces risk. Written partnership agreements that address separation scenarios create clarity before conflict arises, with farming partnership agreements defining ownership, control, and exit routes.

Pre-nuptial or post-nuptial agreements tailored to agricultural assets offer additional protection. They record which property should remain outside future division. For farms with inherited land or multi-generational structures, these agreements protect long-term continuity.

Succession planning also requires attention. Clear documentation of ownership interests and inheritance intentions reduces uncertainty during family change. Plans remain effective only when reviewed alongside relationship developments.

Many farm families choose resolution methods that preserve working relationships. Mediation often allows faster outcomes and lower cost than court proceedings. Structured negotiation supports practical solutions that keep the business operational.

Some farms also benefit from diversified ownership structures. Separating land ownership from trading operations can limit exposure during separation. Clear legal entities create buffers that protect core assets.

Managing Lender and Supplier Relationships During Separation

Farm businesses often rely on long-term relationships with lenders, landlords, and suppliers. Separation can create uncertainty if those parties sense instability or delayed decision-making. Early, controlled communication helps protect trust. Within agricultural finance, lenders are more likely to maintain stable terms when interim arrangements are clear and business payments remain prioritised. Maintaining consistent ordering patterns and payment schedules also reassures suppliers who depend on predictable farm activity.

Clear authority over financial commitments matters during this period. When responsibility for approving expenditure is defined, the business avoids delays that could affect credit terms or service continuity. Farms that manage these relationships proactively often experience fewer operational interruptions while personal matters are resolved.

Tax, Subsidies, and Compliance Considerations

Family change can also affect tax position and compliance. Farm income may shift between individuals, and changes in ownership structure can trigger tax implications if not handled carefully. Separation may coincide with reviews of subsidy entitlements, tenancy arrangements, or business reliefs linked to agricultural activity. Without coordinated planning, farms risk missed deadlines or unintended liabilities.

Family change places real pressure on farm businesses because personal decisions and operations are deeply connected. When ownership, finances, and responsibilities remain clear, disruption stays manageable and continuity is protected. With early structure and coordinated support, farms can remain stable while families adapt to long-term change.